![]() 2021 FINAL REPORT: PDF | POWERPOINT | SYNOPSIS

2021 FINAL REPORT: PDF | POWERPOINT | SYNOPSIS

First Annual Release: The Arizona Budget Then and Now

Arizona Budget: Then and Now illuminates the change in Arizona state spending over the last twenty years. During the 2022 legislative session, it is vital for citizens to be aware of the state’s spending history, the entirety of the budget and the rapid pace of the recent spending increases, and influx of new State & Federal monies.

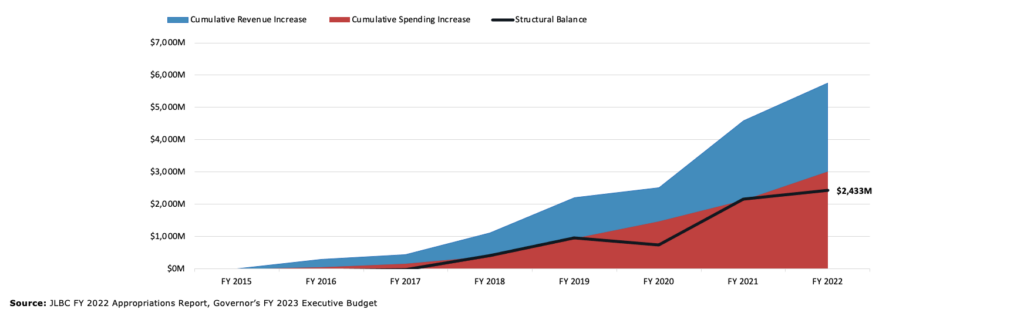

Policymakers are faced with historic General Fund cash and structural surpluses, and revenue growth that is far outpacing Executive and Legislative estimates – all despite record investments in spending areas like Education & Public Safety. A new sales tax on remote-sellers, broader income tax base, and business-friendly policies have spurred rapid tax revenue growth, and revenue collections are structurally outpacing new spending commitments. This trend appears both persistent and growing – the structural surplus has increased from $400 million in FY18 to more than $2.4 billion this year.

Methodology

The findings of this report are generated from the annual appropriations reports compiled by the Arizona Joint Legislative Budget Committee (JLBC) and Governor’s Office of Strategic Planning & Budgeting (OSPB). These reports draw from each of the annual appropriations bills, which authorize funding for each state department. The reports include appropriations from all funds including General Funds and Other Appropriated Funds, and spending from Federal Funds and other Non-Appropriated Funds. In general, “spending” and “appropriation” are used synonymously for appropriated funds throughout this report, unless explicitly clarified.

Appropriated Fund: Legislatively mandated segregation of monies into separate funds, which are specifically subject to the annual Legislative appropriations process. The General Fund (GF) is the state’s largest Appropriated Fund, as opposed to Other Funds (OF).

Non-Appropriated Fund: These funds are statutorily appropriated and not subject to the annual Legislative appropriations process. Subject to available fund monies and state law, an Agency may freely spend these monies. Federal Funds are included in non-appropriated spending.

Federal Funds: Amounts collected and made available to this state by the federal government, usually in the form of grants or matching entitlement funding. Though not subject to Legislative appropriation, the Legislature maintains some control over a subset of Federal Funds through the ‘expenditure authority’ process.

Cash Balance: The remaining, unexpended and unencumbered cash in a fund at the end of a fiscal year. Specifically, revenues minus expenditures plus beginning balance.

Structural Balance: The ongoing balance in a fund at the end of a fiscal year. Specifically, ongoing revenues minus ongoing expenditures. This is intended to reflect the long-term fiscal stability of a particular Fund (typically the General Fund).

Source: http://leg.colorado.gov/sites/default/files/understanding_the_state_budget_information_paper.pdf

Key Findings

- Since 2018, Arizona’s ongoing General Fund revenue growth has averaged 9.5% – versus just 3.8% for the five years prior

- Growth is being fueled by sales and income tax collections and pre-dates the pandemic & associated Federal stimulus.

- Separate accounting by the Department of Revenue clearly flags Arizona’s new remote seller’s sales tax revenues as outperforming estimates.

- This cycle has been the fastest for General Fund revenue growth since the 5-year period ending in fiscal year 2007.

- Policymakers have been able to rapidly increase inflation-adjusted spending for critical areas, like K-12 education, without exhausting the post-2018 surplus and within more traditional revenue expectation limits

- Over the last ten years, real (inflation adjusted) annual K-12 education spending has increased by more than $2.2 billion and is nearly half of General Fund spending. Per-pupil funding (total and inflation adjusted) is the highest it has ever been.

- Despite a 7.8% increase in ongoing spending this year, the projected General Fund structural surplus still increased 12.4% to $2.4 billion.

- Despite policymaker intent, the 2019 Tax Omnibus bill was not revenue neutral and permanently grew the state tax base

- The 2019 Tax Omnibus (Arizona laws 2019, Ch. 273) repealed various income tax exemptions and for the first-time applied state sales taxes to out-of-state sellers; offsetting rate reductions were insufficient to maintain neutrality.

- Current revenue collections and structural surpluses are not sustainable given the state’s ongoing spending needs. The structural balance has increased rapidly from $400 million in FY18 to $2.4 billion this year, despite investments in education, public health & safety, and capital.

- Growth in spending outside of the General Fund (and particularly growth in non-appropriated spending) makes it more difficult for the Legislature and the Public to oversee the growth in government and state spending – policymakers should work to reverse this trend

- Other Fund spending increased 3.6 times faster than General Fund spending over the last twenty years.

Annual Appropriations & Spending

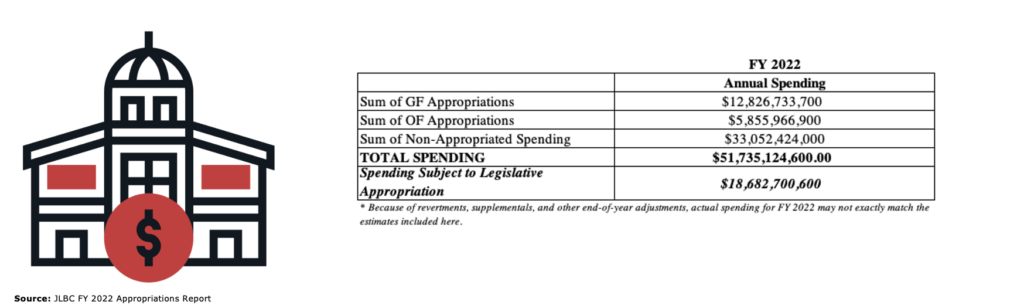

How State Revenues Are Being Spent In FY22

Each year, the state’s legislature approves the General Appropriations Act – a single budget omnibus that dictates how most public revenue will be spent. The Legislature additionally approves dozens of individual spending and appropriations bills. While all public money generated by state taxes and fees is subject to appropriation, some funds are statutorily or continuously appropriated and not subject to the annual budget process. Federal and certain non-State monies are not subject to appropriation by the Legislature but may be subject to some other statutory control.

State Government Revenues – Where It Comes From

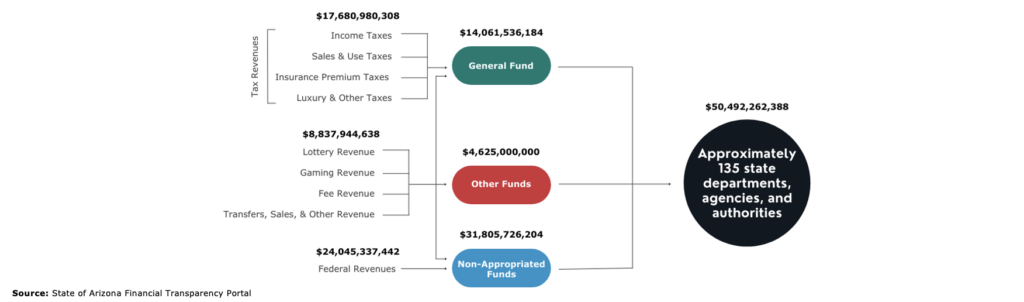

Flow of Tax & Non-Tax Revenue from the Source to State Agencies in FY21

The image above displays the flow of state revenue from the tax, fee or other revenue source to the state agency that is authorized to spend it. There are many different types of state agencies, and many different types of revenue, and the Legislature ultimately determines who receives what. The flow above is intended to be generally illustrative only.

Critically, we note that a substantial majority of revenues are collected from non-tax sources, and 72% of all revenue is deposited into funds other than the General Fund.

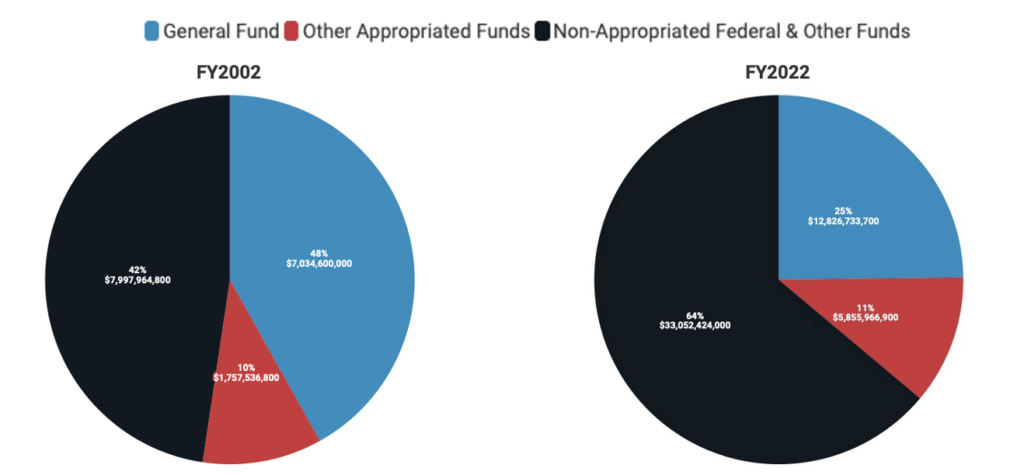

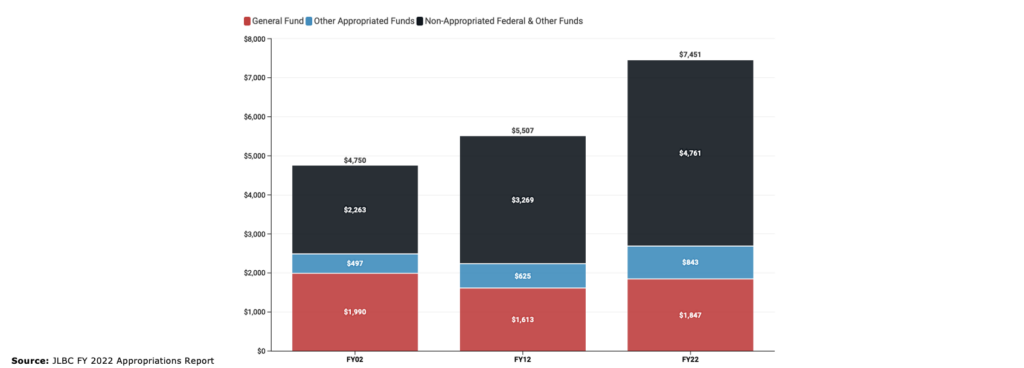

Arizona Total Spending by Fund Type in FY02 & FY22

Total appropriated and non–appropriated spending in FY22 is estimated to be up to $52 billion. While appropriated spending is 36% of this total, 64% of expenditures are non-appropriated and much of this spending occurs outside the annual legislative budgeting process. Over the last twenty years, the General Fund share of total spending has declined from almost half to only a quarter, while non-appropriated spending has increased from less than half to nearly two-thirds of all spending.

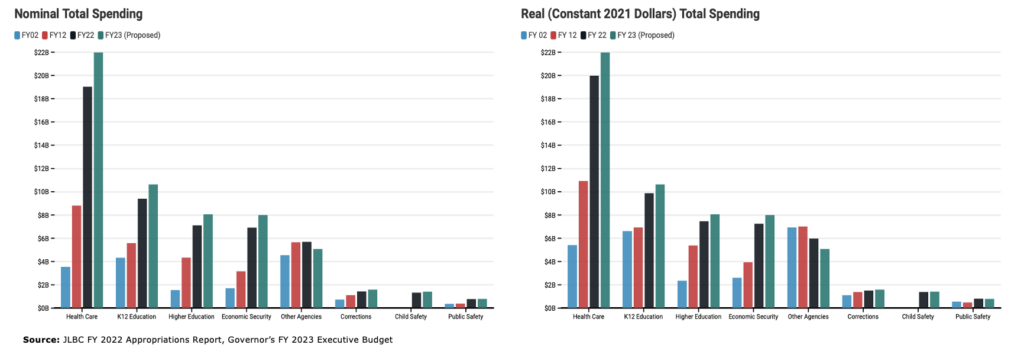

Change in Total Spending By Area

From FY02 to the FY23 Governor’s Budget Request

Between FY12 and FY22, total spending nearly doubled on a nominal basis – from $29.1 billion in FY12 to an expected $51.7 billion in FY22 – and even on a real inflation-adjusted basis the increase is over 50%. Much of this spending occurs at the discretion of the Federal Government or of individual agencies, with limited Arizona policymaker and public oversight through statutory authorization and controls.

Appropriations to K-12 and higher education consumed nearly half of General Fund spending in FY22 – a 20% increase in their share of total spending versus FY12. Adjusted for inflation, K-12 education spending increased by over $2.9 billion in the last 10 years, including $1.8 billion from the General Fund.

Change in Real Total Spending Per Arizonan

From FY02 to FY22

Since FY02, real spending per capita in Arizona has increased by over 56%. Most of that growth has occurred outside the General Fund, in Other Appropriated Funds and particularly in Non-Appropriated Funds. 2014’s Medicaid expansion was a large driver of this growth. Within the General Fund, K!2 education has seen the largest increase.

Given tax revenue flows to the General Fund, Arizonans have enjoyed relatively stable taxes backfilled by an increasing reliance on non-tax fee and Federal revenues.

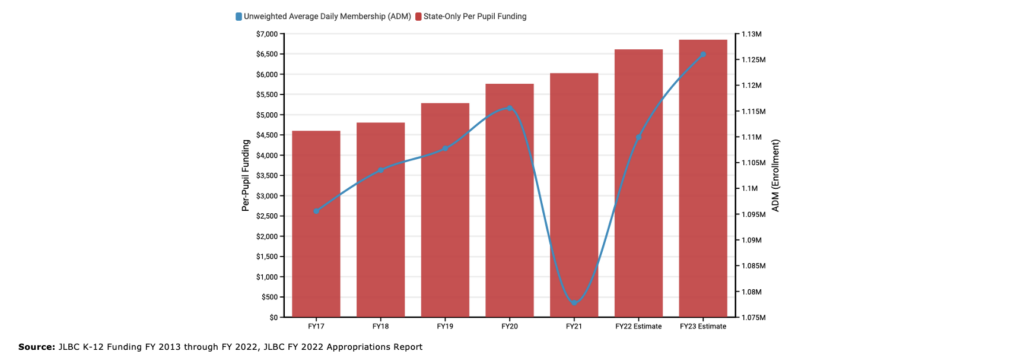

Change in State-Only Per Pupil K-12 Funding in Arizona

From FY17 to FY23

Between FY17 and FY22, State-only per pupil funding in Arizona increased by 44%, and by next year that could rise to a nearly 50% increase in funding over just six years. Over the same period, there has been growth in local property tax revenues and federal funds, which go directly to local districts. This has occurred even as K-12 enrollment has remained well below pre-pandemic levels. The enrollment (ADM) estimates for FY22 & FY 23 in above image are likely too high, as current actual enrollment according to ADE are less than 1.1 million. If current enrollment trends continue, per-pupil funding at the Governor’s recommended level could be over $7,000.

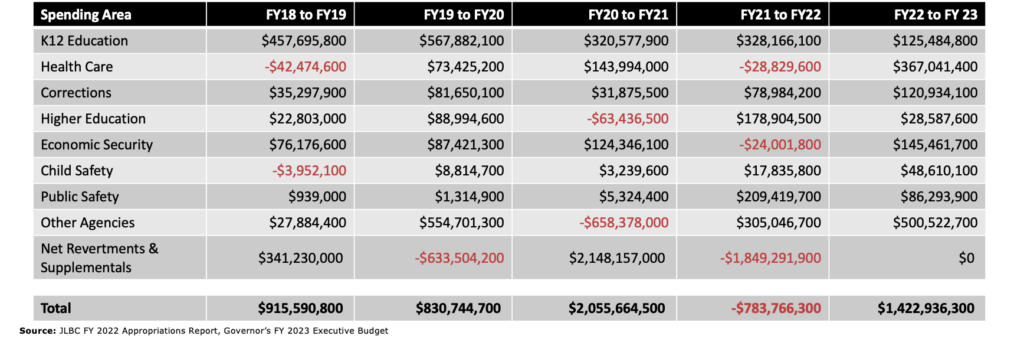

Change in General Fund Spending By Area

From FY18 to the FY23 Governor’s Budget Proposal

Note: Values in the chart above are in terms of spending, not appropriations, and for years prior to FY 22 account for revertments, supplementals, and other end-of-year adjustments. For FY22 and the FY23 Executive Budget, appropriations are used as a proxy for spending, as actual spending figures are not yet available.

In FY 21 General Fund spending increased by over $2.0 billion, after accounting for approximately $1.8 billion in supplementals and other end-of-year adjustments – including approximately $2 billion in supplemental spending for repayment of State pension and general obligation debt. Revenues during the same time exceeded early (pandemic-era) projections by nearly $3 billion. Based on current approved levels, General Fund spending will fall by nearly $800 million this year.

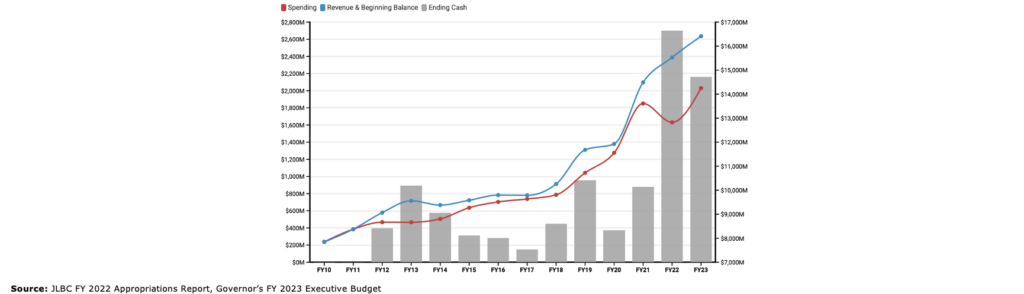

General Fund Revenue and Spending Growth From FY10 to the FY23 Governor’s Budget Proposal, including Ending Cash Balance

Since FY18, General Fund revenue growth has exhibited rapid growth, far outpacing prior trends. While spending growth has increased as well, it has failed to keep pace , resulting in increasingly large General Fund cash surpluses. This trend is likely not sustainable and cash reserves should be carefully managed to avoid substantial new, ongoing commitments that could jeopardize long-term fiscal stability.

In the 8 years ending FY18, General Fund revenue growth averaged 3.8%, while spending growth kept pace at 3.3%. During the 2019 Legislative session, policymakers both retroactively conformed to the federal Tax Cuts & Jobs Act – which expanded the income tax base – and adopted Wayfair remote sellers’ legislation – which expanded the sales tax base. Since then, revenue growth has averaged 10.1%/year, and spending growth has accelerated to 8.0%/year.

Cumulative Ongoing General Fund Revenue & Spending Growth

FY16 to FY23

For the first time since the Great Recession, the Arizona General Fund is not only structurally balanced but – after five consecutive years – the state has the longest-running and largest ever structural surplus. Rapid revenue growth began around FY19-FY20, following the State’s conformity to Federal income tax law changes and enactment of its own remote seller’s tax. Since then, revenue collections have exceeded budget forecasts by a combined $4 billion, and the state has added more than $3 billion in new ongoing spending and over $5 billion in new ongoing revenue.

Structural balance is a powerful indicator of a state’s long-term fiscal health, because states whose ongoing spending commitments outpace ongoing revenues must reduce assets or accumulate new liabilities to maintain spending.

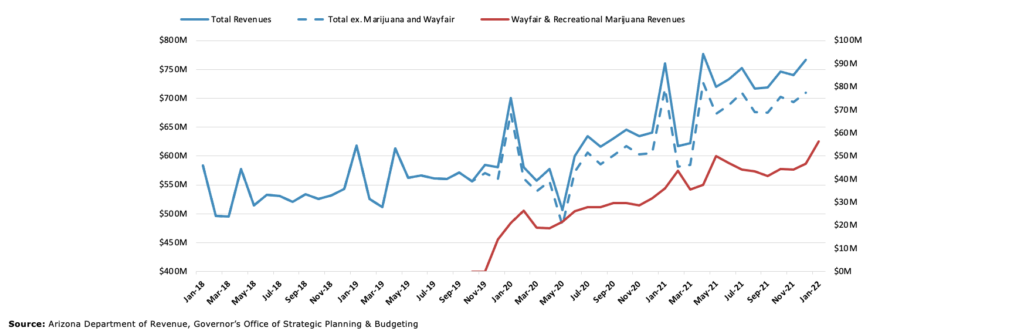

Monthly TPT Collections With Arizona Remote Sellers & Marijuana Tax

Since enactment in 2019, Arizona’s new Wayfair remote sellers’ tax has added nearly $1 billion in new sales tax revenues – versus JLBC projections at the time that it would bring in less than $150 million over the same period. Similarly, since 2018 and passage of and state conformity to the 2017 Tax Cuts & Jobs Act, Arizona Individual Income Tax collections have grown by 11.4%/year, versus just 5.0% for the 4-years immediately prior. This excess growth has created $1.4 billion in new, unanticipated income tax revenue. Together these effects account for the state’s current structural surplus.

Clearly – despite policymaker intent – the 2019 Tax Omnibus bill was not revenue neutral.

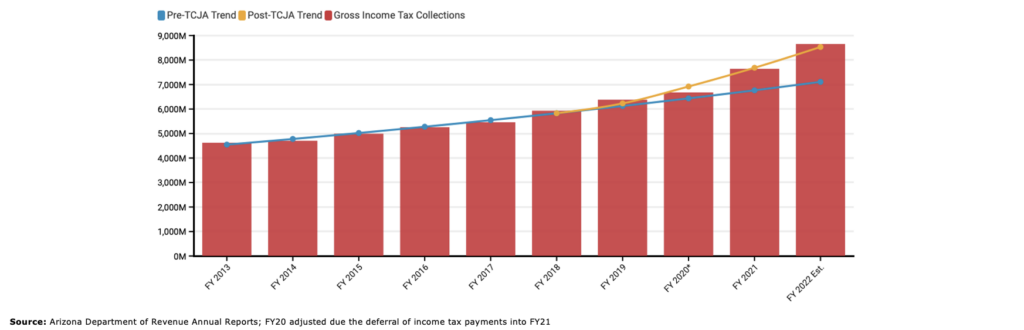

Gross Individual Income Tax Receipts Pre- & Post- Tax Cuts & Jobs Act

Over six years between FY13 and FY18, income tax, receipts as reported by the Arizona Department of Revenue, followed a remarkably stable trend with an annual growth rate of less than 5.0%. Beginning with tax year 2018, the state permanently conformed to the federal Tax Cuts & Jobs Act, which expanded the definition of Federal Adjusted Gross Income. That conformity included offsetting income tax reductions – including rate cuts, a larger standard deduction, and other changes – which were intended to be roughly revenue neutral.

Since then, growth has averaged over 10%/year and again displayed remarkable stability despite the pandemic and other recent policy changes.

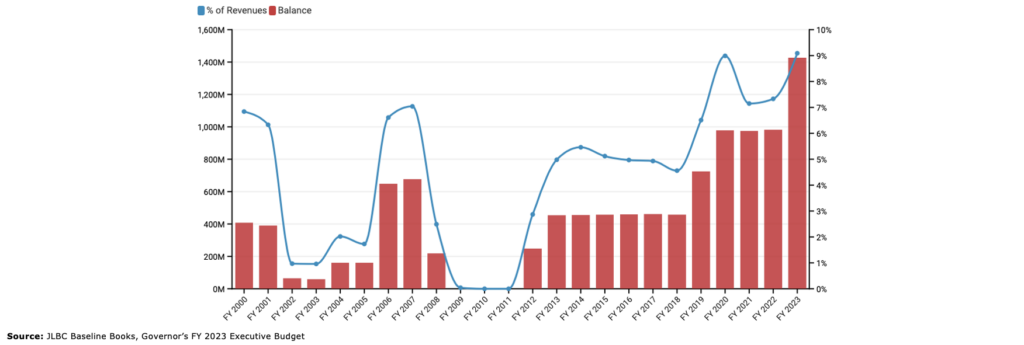

Arizona’s Rainy-Day Fund With the Governor’s FY23 Budget Request

The Budget Stabilization Fund – Arizona’s primary cash reserve – has remained at approximately $1.0 billion, or just over 7% of General Fund revenues for three years. The statutory limit is 10% of General Fund revenues, and the national median is 10.8%.

To bring Arizona closer to its statutory limit and national standards, the Governor’s FY23 budget request deposits an additional $425 million into the Fund. This deposit is reflected on the chart above but will not occur without legislative action.

Proposition 208 Income Tax Surcharge and the Arizona State General Fund

-

- According to the Joint Legislative Budget Committee, Proposition 208 would have generated $939 million in new tax revenue, had it not been unconstitutionally constructed.

- According to the Governor’s Office of Strategic Planning and Budgeting, Prop 208 would have reduced General Fund revenues by a cumulative $1.5 billion over the next four years. A final court ruling eliminating this tax means those costs will no longer occur, and the revenue will return to the General Fund without other policymaker action.

- Given the recent Court of Appeals decision declaring the surcharge unconstitutional, policymakers will likely have even more resources than already anticipated.

- Because of statutory clarity and Department of Revenue guidance, it is unlikely significant amounts of money were received by the State prior to the ruling, and setting resources aside is probably unnecessary.

Highlights of the Governor’s FY23 Budget Proposal

As the Legislature contemplates spending for FY23, a major discussion point will be elements included in the Governor’s proposal. We have identified the following elements as being noteworthy:

-

-

- $425 million deposit into the State’s Budget Stabilization Fund.

- $133 million in new tax reductions – including $58 million for business personal property and income tax changes.

- $1 billion over three years for water sustainability.

-