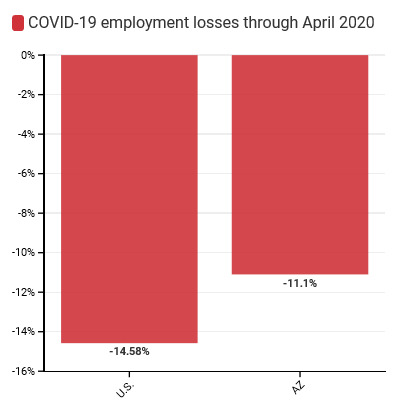

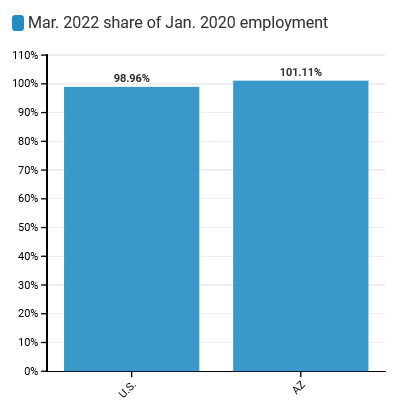

Arizona shed 3,700 nonfarm jobs in March (-0.12%) but the Unemployment Rate declined by 0.3 percentage points to 3.3% – one of the lowest unemployment rates ever recorded in the state. This is the first time since July 2020 that Arizona has experienced a net decline in nonfarm employment, month-over-month. However, total employment – measured by the Bureau of Labor Statistics using a different survey from nonfarm payrolls – increased by 14,227 workers. Given the wide discrepancy in these numbers and their preliminary nature, we expect data revisions to follow. Since April 2020, the State has added over 372,000 jobs and regained 101.1% of its pandemic-related job losses. Arizona’s manufacturing sector continues to overperform, growing 3.6% over the past year and experiencing the 5th fastest recovery in the country.

Key Findings—Arizona February 2022 Employment Data (BLS CES Survey[i])

- Arizona lost 3,700 total nonfarm jobs in March (a monthly decline of (0.12%) and a total year-on-year change of +3.7%).

- The state surpassed its pre-pandemic peak level of jobs in November 2021 – making it only the fifth state at the time to have done so.

- However, the State remains about 153,500 jobs below its 2017-2019 trend, and based on current growth rates will not achieve that level until mid 2023.

- Arizona’s labor market has outperformed the United States throughout the pandemic years – losing fewer jobs than all but 10 other states during the 2020 recession and regaining lost jobs faster than all but 4 other states.

- Thirteen states have employment levels above what they were at the start of the pandemic. Utah continues to have the highest differential (+5.0%).

- Hourly wages in Arizona increased by 6.6% over the 12-months ending in March, versus a 5.6% average increase for the United States as a whole.

- While the average private sector worker is now making 9.9% more than they were prior to the pandemic, inflation over the same period was over 12% – meaning real average hourly wages were down (2.1%) over the past two years.

- There is evidence that rapid wage growth – likely inflation and demand driven – began to cool in March; 31 states including Arizona experience month-over-month declines in average hourly wages.

A Deeper Dive into Arizona Industries

- Arizona’s economy continues to exhibit divergent trends between its service and goods-producing sectors. Though the leisure and hospitality industry has led the recovery by adding 36,000 jobs over the past year, it is still down 9,200 jobs relative to March ‘20.

- Arts, entertainment, and recreation is down 10.6% (5,100 jobs).

- Accommodation is down 1.5% (4,300 jobs).

- Manufacturing is up nearly 6,000 jobs relative to its pre-pandemic peak. Arizona added 700 new manufacturing jobs in March (even as the state shed nonfarm positions overall) and contninues to have the fifth-fastest recovering manufacturing sector in the country.

Arizona Labor Force Update

Arizona’s Labor Force Participation Rate declined slightly in March despite declining unemployment rates as 5,300 new individuals began looking for work – significant growth but insufficient to keep pace with the state’s rapid population growth. There are now more than 3.5 million people in the state’s labor force – the highest it has ever been since the Bureau of Labor Statistics began keeping track in 1976.

Key Findings—Arizona March ‘22 Labor Force Data (FRED[ii], and IPUMS-CPS[iii])

- March’s LFPR decreased slightly to 60.7%, and remains below its 2019 level of 62.2%.

- At the current population, this gap would equate to approximately 107,000 additional willing workers.

- However, even at a reduced participation rate, in-migration – Arizona added over 125,000 new residents during the pandemic – has surged the states labor force to its largest level ever.

- February’s unemployment rate fell by 0.3 percentage points, to 3.3%.

- This is one of the lowest unemployment rates ever recorded for the state of Arizona, and is difficult to reconcile against the Establishment Survey report of month-over-month declines in nonfarm employment.

- After reversing a 20-year trend of declining Labor Force Participation between 2017-2019, the participation rate declined precipitously during the pandemic, and resumed its downward trend in mid-2021.

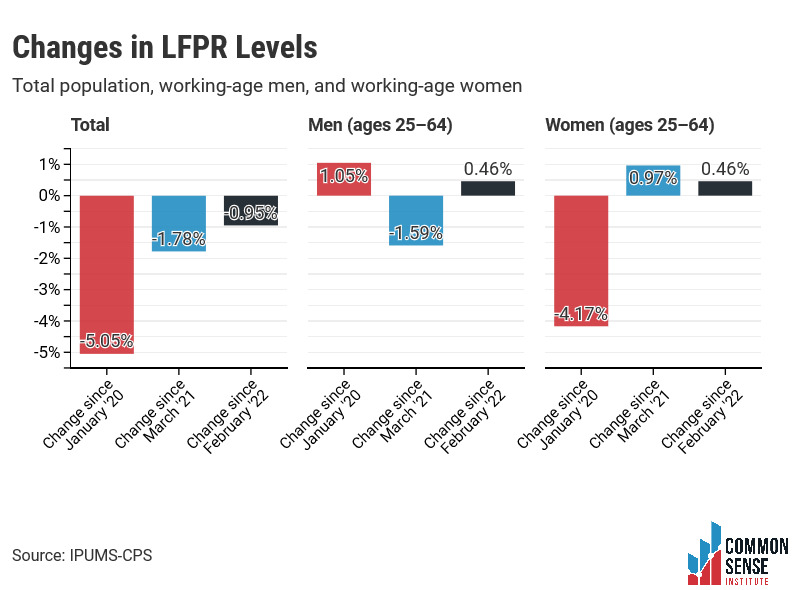

- Labor force participation in Arizona declined 1.78% over the past year, and 5.05% since January 2020 and the start of the pandemic.

- Declines were concentrated among prime-age women and older workers. Since 2020 the participation rate for women aged 20-64 has decreased (4.17%), while the participation rate for prime-aged men increased 1.05%.

- However, over the past year this trend has reversed, with working-aged males entering the states labor force more slowly than population growth even as working-aged women began to reverse some of their pandemic-era trends.

- Some of this may have been driven by household necessity in response to temporary school or daycare disruptions during the pandemic and household choice to have women fulfill required child-watching roles.

© 2022 Common Sense Institute

[i] https://data.bls.gov/cgi-bin/dsrv?sm

[ii] https://fred.stlouisfed.org/

[iii] https://cps.ipums.org/cps/